Local Economic Report

Published 8:08 am Tuesday, March 22, 2016

- Local Economic Report

By Dr. Anthony J. Greco

The Acadiana area economy is struggling and can no longer be said to be outperforming the National and State of Louisiana economies. The national economy, while growing, still cannot be described as robust. Though consumer spending rose by 4.3 percent in the fourth quarter of 2014 (the largest quarterly increase since 2006), it has risen by an average of 2.8 percent over the first three quarters of 2015, with its highest increase being 3.6 percent in the second quarter of 2015. The drop in energy prices should lead to increased consumption spending. The current U.S. unemployment rate is 5 percent. At the end of 2014, the rate was 5.6 percent. Part of the decline is attributable to the fact that many people have stopped looking for work, lowering the Labor Force Participation Rate to an historic low of 62.6 percent in December of 2015. This end-of-year measure has declined since 2006. In 2014, 2.9 million jobs were added for a monthly average of 242,000. In 2015, employees added 2.7 million jobs for a lower monthly average of 225,000. Although many of these jobs in both years were part-time jobs, 2015 is the second strongest year of job growth (behind 2014) since 1999.

br

Wages posted its strongest gain since 2009 with an increase of 2.5 percent. Wages had increased by only 1.7 percent in 2014. Gross Domestic Product had expanded by a healthy 4.6 percent in the second quarter of 2014 and by 4.3 percent in the third quarter of 2014. However the rate of increase fell to 2.1 percent in the fourth quarter of 2014 and plummeted to a 0.6 percent increase for the first quarter of 2015. It rebounded well to a 3.9 percent increase for the second quarter of 2015, but slowed to a 1.5 percent increase by the fourth quarter of 2015. From the third quarter of 2014 to that of 2015, GDP grew by 2.1 percent. It had grown by 2.4 percent for 2014. These are all less than our historical rate growth. A modest rate of growth is expected for the first half of 2016.

br

Other components of GDP have displayed signs of weakness. Business investments declined and export spending and government spending had modest increases from the second to the third quarter of 2015. Our national debt exceeds $18.15 trillion, a second high and rising. Our debt to GDP ratio has grown from 76 percent in 2009 to 100.5 percent for the third quarter of 2015.

br

Confidence in the U.S. economy has generally increased recently. The Conference Board Confidence Index rose from 93.1 in December 2015 to 102.9 in January 2016, its highest level since August 2007. This reflects a more positive assessment of current business conditions and of the condition of the labor market, as well as future prospects for the state of business and that of the labor market. In addition, notable increases were observed in the Board’s Situation Index (rising from 99.9 to 112.6) and in its Expectations Index (rising from 88.5 to 96.4). Further, the NFIB Business Optimism Index increased from 94.8 Index Points in November 2015 to 95.2 Index Points in December 2015. Higher sales expectations and increased hiring and business expansion plans led to this more optimistic outlook. However, the December 2015 ISM Report on Business indicated that economic activity contracted in December 2015 for the second consecutive month even as the overall economy grew. A reading above 50 percent in the indices of this report generally indicates expansion in the manufacturing sector. Construction in indices for new orders, production, employment and raw materials inventories accounted for the overall softness noted for December 2015. Of 18 manufacturing industries, six reported growth in December while the remainder of the industries reported contraction.

The Acadiana Score Card

br

From 2010-2014, shown in Table I, the unemployment rate in RLMA4 fell from 6.64 percent to 5.6 percent, but had trended upward since 2011. Further, for the first 10 months of 2015, the rate was up to 6.6 percent. Lafayette City’s unemployment rate had fallen from 5.8 percent in 2010 to 5.1 percent in 2014. However, that rate rose to 5.7 percent for the first 10 months of 2015.

br

Table II shows unemployment rates for the eight parishes comprising RLMA4 for November 2014 and November 2015. Rates for six of the eight parishes, including Lafayette and Iberia, rose from 2014 to 2015. Still, Lafayette Parish at 5.5 percent had the lowest rate of unemployment while Iberia Parish had the highest at 7.9 percent.

br

Table III shows average employment for the eight parishes from 2009-2014. Employment rose in Lafayette Parish and fell slightly in Iberia Parish, reflecting a drop-off from 2013-2014. Lafayette and Iberia Parishes rank first and second throughout. Lafayette and four other parishes had employment increases from 2013 to 2014 while Iberia and two other parishes had slight decreases. In the second quarter of 2015, average employment rose in both Lafayette and Iberia Parishes.

br

However, the second half of 2015 ushered in a downturn in the energy sector and an accompanying drop in oil and gas prices. Although final annual employment data are not available, there is ample evidence of the negative effects of the energy downturn on area employment. Available jobs have decreased in six of the state’s nine Metropolitan Statistical Areas (MSAs), remained unchanged in one MSA and have risen in two MSAs from November 2014 to November 2015. The Lafayette MSA comprised of Acadia, Iberia, Lafayette, St. Martin, and Vermilion Parishes, had the highest drop in jobs with 5,500 in 2015. The second largest decrease occurred in the Houma-Thibodeaux MSA. The Lafayette and Houma-Thibodeaux MSAs were the only ones experiencing a rise in the unemployment rate over the November 2014-November 2015 period. Lafayette MSA had the highest unemployment rate over this year at 6.3 percent. This 6.3 percent unemployment rate placed the Lafayette MSA in a six-way tie for number 327 out of 378 MSAs in the U.S. This further attests to the trouble in the area’s economy. Last year the Lafayette MSA unemployment rate was 4.9 percent tying it with eight other MSAs for the 139 place in the country.

br

Further, LEDA reported in January that 2,300 oil and gas jobs had been lost due to the energy sector’s downturn and that it was expected that 4,000 additional jobs would be subsequently lost in 2016. Hence, with sustained decreases in the prices of oil and gas, the local economy appears to be in for rough times through at least 2016.

br

Average weekly earnings in Table IV increased over 2009-2014 by 16.3 percent for RLMA4 and by 17 percent and 17.4 percent respectively for Lafayette and Iberia Parishes. These earning were lower for RLMA4 and Lafayette and higher for Iberia in the second quarter of 2015.

br

Inflation-adjusted annual wages for Louisiana, RLMA4 and Iberia and Lafayette Parishes are shown in Table V. The average annual wage for both Lafayette and Iberia Parishes exceeded those of the state and RLMA4 for each year of 2009-2014. Real wages increased by 2.75 percent for Lafayette Parish and 2.95 percent for Iberia Parish from 2013-2014. The percentage increases for RLMA4 and the State of Louisiana were 2.28 percent and 1.43 percent, respectively. None of these increases are especially impressive though they are typical of the times.

br

Table VI illustrates that the value of new residential activity in Lafayette Parish had increased over 2010-2014 from $133,289,456 to $241,519,459, falling slightly in only one of the year-to-year changes. However, the value of new residential activity did decline to $208,272,361 in 2015, a decrease of nearly 13.8 percent from 2014. There was a 9.7 percent decrease in the number of new residential units from 2014 to 2015. Likewise, there had been a significant increase in the value of new commercial units from $65,862,181 in 2010 to $154,833,195 in 2014. However, the value dropped to $127,583,114 for 2015, a decline of 17.6 percent. The number of new commercial units actually increased from 62 in 2010 to 65 in 2015.

br

In 2008, Lafayette home sales dropped from 2,675 in 2007 to 2,287, a 14.2 percent decrease as a result of the Great Recession. They finally rebounded in 2012 with a 22.5 percent increase over 2011 sales. Sales then increased by 21 percent in 2013 and by 3.2 percent in 2014. Although 2015 was another second-setting year for home sales, sales actually declined for the last five months of 2015. Final 2015 sales were 3309, 0.064 percent ahead of the 2014 sales of 3,288. January to July sales were up 7.6 percent over 2014, but sales from August through December were 8.25 percent lower than the same period in 2014.

br

Total retail sales for Lafayette and Iberia Parishes are presented in Table VII. From 2010 to 2014, retail sales increased by 32.6 percent in Lafayette Parish and by 7.4 percent in Iberia Parish. However, Lafayette Parish had a 5.5 percent drop in year-to-date sales from January-October 2014 to January-October 2015. Over the same period, Iberia Parish had a 4.4 percent drop in retail sales.

br

Oil prices are continually important to the Acadiana Region. Table VIII illustrates that prices for Louisiana Sweet Crude rose over 2010-2014, though falling from 2013-2014 by 10.5 percent. Oil surpassed $100 a barrel in February 2011 and generally remained above that through August 2014.

br

The price of oil declined from September through December when it was $61.90. From December through May 2015, the prices increased three times and decreased twice. With the exception of September 2015, it has fallen once since then. Notice the volatility of oil prices. They actually increased by nearly 30 percent over 2010-2013. From 2013 through the first ten months of 2015, they have decreased by 49.2 percent. The fall in prices since 2013 has essentially been caused by increased supply coming principally from U.S. fracking and horizontal-drilling operations coupled with the maintenance of high levels of production by Saudi Arabia, as well as, demand cutbacks resulting in China and Europe. The resulting excess supply is expected to persist for some time. Iran is expected to renew production efforts in the wake of the removal of U.S. sanctions. However, demand for lower-priced gas is increasing by U.S. drivers. Further, some references will soon close for conversion to summer-grade gas. Cutbacks in production will continue as more U.S. producers find it unprofitable to produce in the face of lowering gas prices. Then there remains a probable disruption caused by terrorism and general unrest in the Middle East. Hence, the overall market for gasoline will continue to be characterized by volatile conditions relative to domestic and international demand for and supply of gasoline.

br

Table IX shows that drilling permits were generally falling in the State of Louisiana over 2010-2015 though they did increase from 2011-2012. The year-to-date decreased over the first nine months of 2014 to the first nine months of 2015 was 22.8 percent.

br

The number of rigs operating in Louisiana is shown in Table X. As shown, the number of rigs declined from 2010 through 2013. They increased slightly from 2013 to 2014. However, there has been a year-to-date decrease over the first nine months of 2014 to those of 2015 of 27 percent.

br

The price of Louisiana natural gas hit a nearly three-year high at $8.86 per million British thermal units, or MMBtus, and through 2014 has risen in three years and fallen in three years. It averaged $4.39 in 2014. It opened at $2.99 in January of 2015 and increased in only two months of 2015. Its December 2015 price of $1.93 marked a 17-year low. Marketed production of natural gas averaged 79.6 billion cubic feet in 2015, a 6 percent increase from 2014. The U.S. Energy Information Administration predicts that growth in production will slow in 2016 to 0.7 percent over 2015 and will rise slightly by 1.8 percent in 2017. Similar to oil, natural gas pricing has suffered from overproduction and lower-than-expected demand.

br

br

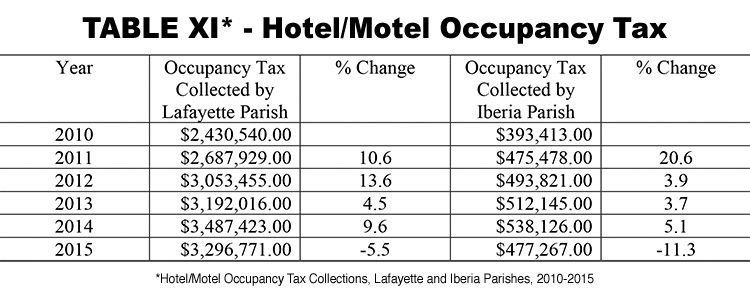

Hotel/Motel Tax Receipts

br

Occupancy tax collections, as shown in Table XI, increased for both Lafayette and Iberia Parishes in each year from 2010 through 2014. However, they decreased for both parishes in 2015 with a 5.5 percent decrease in Lafayette Parish and an 11.3 percent decrease in Iberia Parish.

br

br

Cost of Living

br

In the cost of living study of the Council for Community and Economic Research, the national average for all areas is 100. A score below 100 indicates that an area’s living cost is below the national average and vice versa for a score above 100. Lafayette’s overall index for the third quarter of 2015 was 89.7 and its indices for groceries, housing, utilities and health care were below 100. Its transportation index was 101. Through 2014 and into 2015, the Acadiana economy was doing quite well. However, the decline in oil and gas prices beginning in mid-2015 has had negative impacts on the area. Unemployment rates have risen in the city of Lafayette, in Lafayette and Iberia Parishes and in the RLMA4. Retail sales, the value of new residential and commercial units constructed and hotel/motel occupancy tax collections are down in both Lafayette and Iberia Parishes. Further, drilling permits issued and operating rigs have declined. Low prices in oil and gas are likely to persist through the better part of 2016 bringing continued downward pressure on the Acadiana economy.

br

Louisiana’s unemployment rate was 6.5 percent for November 2014. It went down to 6.3 percent for November 2015 and was set on a preliminary basis at 6.1 percent for December 2015. The 6.1 percent level puts it in 44 place among the 50 states. The lowest rate is 2.7 percent for North Dakota and the highest is 6.7 percent for New Mexico. Over the past year, the unemployment rate fell in seven of the nine state MSAs. The two exceptions were the Lafayette MSA and the Houma-Thibodeaux MSA, the areas affected most by the decline in energy prices.

br

Like many states, Louisiana has ongoing budgetary troubles. Weak tax collections due to severance taxes and royalties associated with oil, as well as increasing education and health care obligations, have led to painful spending cuts, which are likely to continue in the near term. A new governor and his fledging team are considering various changes in the state’s revenue generating strategy.

br

Despite this, there are some positive signs. Personal income in the state rose by 1.1 percent in the third quarter of 2015. Its rate of increase had been less than 1 percent over the three previous quarters. Although this increase ranked Louisiana 43 among the states, the average increase for the nation was 1.3 percent. Further, seven other states also experienced a 1.1 percent increase as did Louisiana. For 2014, Louisiana’s exports exceeded $65 billion, an increase of nearly 3 percent from 2013 and marked the sixth consecutive year of growth. As it did in 2013, Louisiana ranked sixth among the states in its value of exports. The state’s leading export categories include: petroleum and coal products, agricultural products, chemicals, processed foods and machinery, except electrical. Data for 2015 are expected to reflect further export increases, which are also projected for 2016. The state’s Gross State Product advanced for fiscal year 2015 to $260.8 billion, which represented a 3.1 percent rate of growth over fiscal year 2014. This tied Louisiana for 19th place with three other states. Notice that this rate of increase exceeds the recent levels of U.S. GDP growth.

br

The state will continue to try to attract new industries and expand existing ones. The ending of the ban on U.S. crude oil exports and the reestablishment of trade relations with Cuba should enhance Louisiana’s shipments of crude oil and agricultural products, notably rice. Increasingly important is the film and television industry. Often referred to as “Hollywood South,” the state actually overtook Hollywood in 2013 with 18 films produced within its borders. Although the state dropped to sixth place with its 2014 productions, it has hosted a number of blockbuster films in 2015 and will likely continue to rank high among states in production activity.

br

In summary, the Acadiana area will likely continue to face difficult economic times in 2016 due to the fall in oil and gas prices. Some relief should come in the latter part of the year as changes in supply and demand conditions relative to energy work to alleviate the current excess supply of oil. The state will struggle with budgetary issues, but should show overall improvement. The national economy will continue its non-spectacular growth pace.