IPSB votes parents responsible for athletic insurance

Published 12:15 am Monday, June 25, 2018

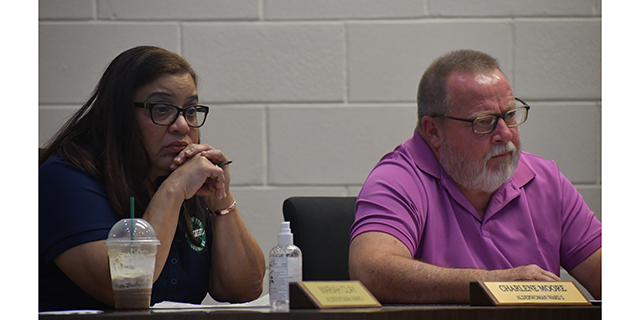

- Carmel Breaux of Norris Insurance Consultants made recommendations to the Iberia Parish School Board Wednesday night on how to save costs for the upcoming fiscal year.

Parents of student-athletes in Iberia Parish will have to pay out of pocket for blanket insurance coverage after a vote by the Iberia Parish School Board Wednesday night.

Trending

The board voted to pass a recommendation by Carmel Breaux of Norris Insurance Consultants last week in an effort to cut costs in tight financial times.

“We have covered them as long as we could when we had the money, but now we just don’t have the money,” IPSB First Vice President Elvin Pradia said at Wednesday’s meeting.

The board’s all sports plan blanket coverage has been steadily increasing in costs.

In 2016, the premium costs for coverage was $91,984. In 2017 it increased to $112,561. The recommended plan had the board decided to keep the coverage would have cost $191,120 for the next school year, an increase of $78,559.

“It is my recommendation that the board not continue the all sports plan blanket coverage,” Norris said.

The board voted to agree with Norris with the exception of the Rev. Arthur Alexander who was the only “nay” vote.

Trending

Board members said that information explaining insurance options for parents will be disseminated through area principals.

Board members said that this is not the first time in the board’s history that parents were responsible for insurance costs.

“Parents used to have to pay for coverage, I paid for my children,” Board attorney Wayne Landry said.

The school board will still be responsible for covering catastrophic events as it relates to injuries during athletic events at school.

Parents can expect to receive more information on their coverage options from local schools.

“The beginning of the school year will not be the only time parents may have the option to choose coverage,” Norris said.

“For example, if a parent has coverage from their job at the beginning of the school year and then become unemployed by December they will have the option to elect coverage at that time,” she said.

Norris also made recommendations to the board concerning their liability coverage which includes auto liability and physical damage, public officials errors and omissions at a cost of $368,453 premium.

Other figures included equipment breakdown at a $50 million dollar limit with a premium of $7,081, crime insurance at $500,000 limit with a premium of $5,250, workers compensation insurance at $77,426, flood insurance at a premium rate of $52,899 and student accident insurance at $10,321.

With the recommendations by Norris implemented by the board, she said the board will end up seeing a savings in this year’s insurance costs.

The total amount spent in 2017 was $549,679 and in 2018 the costs are at $521,430, a savings of $28,249.